In the 12 months to January 2019, 1.59 million Australians used one of the latest ‘buy-now-pay-later' digital payment methods, with Millennials making up the biggest share.

These are some of the findings from the newly released Roy Morgan ‘Digital Payment Solutions Currency Report' January 2019.

The data in this latest report is from Roy Morgan's Single Source survey which is based on in-depth interviews conducted face-to-face with over 50,000 consumers per annum in their homes.

Results presented here are based on interviews conducted in the 12 months to January 2019.

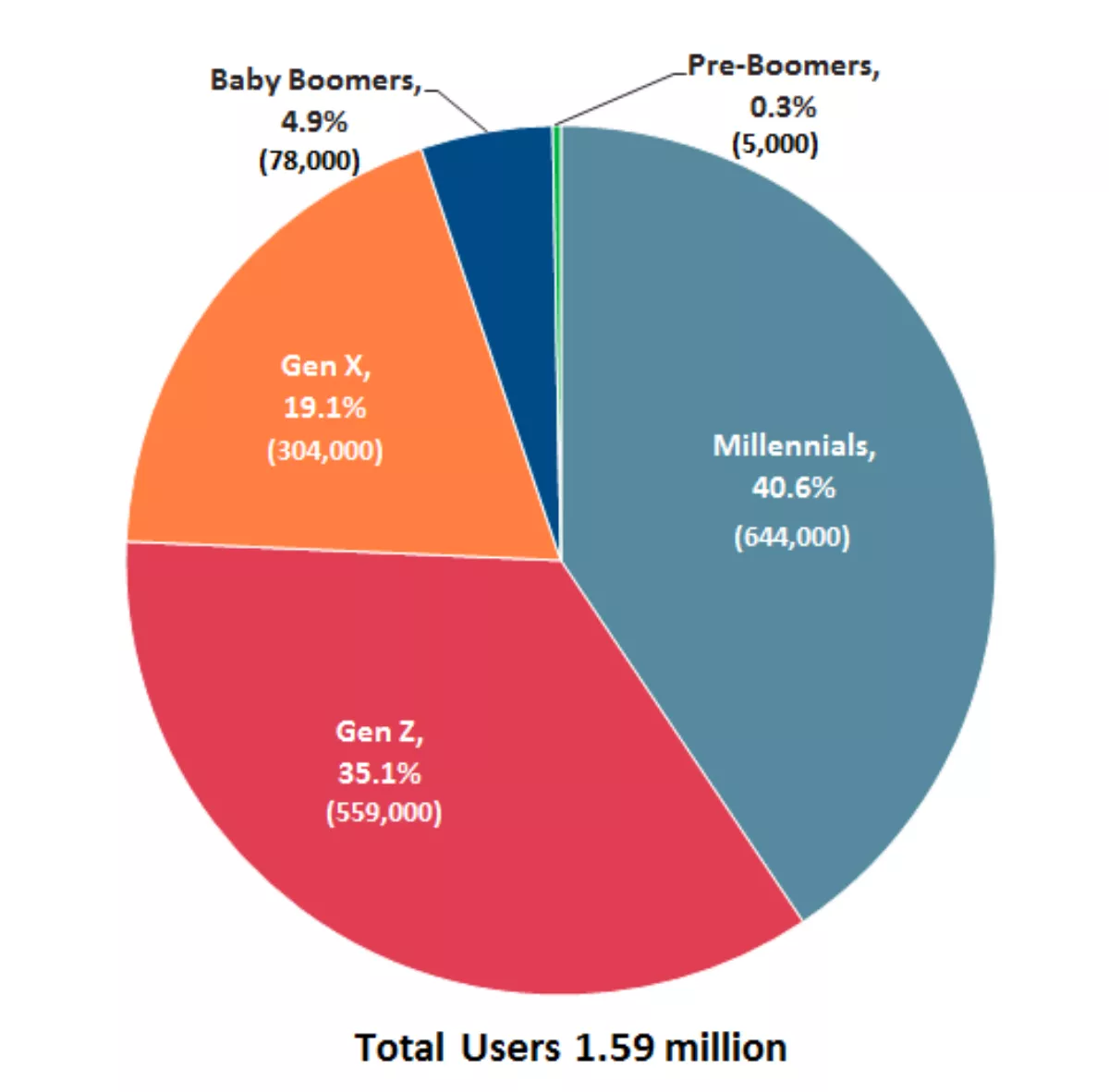

The following chart shows that millennials account for 40.6% of ‘buy-now-pay-later' users followed by Gen Z with 35.1%.

These two generations combined account for over three quarters (75.7%) of the market or 1.2 million consumers.

The two oldest generations (baby boomers and pre-boomers) by contrast make very little use of the new ‘buy-now-pay-later' systems with a combined market share of only 5.2% (83,000).

Buy-Now-Pay-Later Usage in Last 12 Months: Market Composition by Generations

Source: Roy Morgan Single Source (Australia)

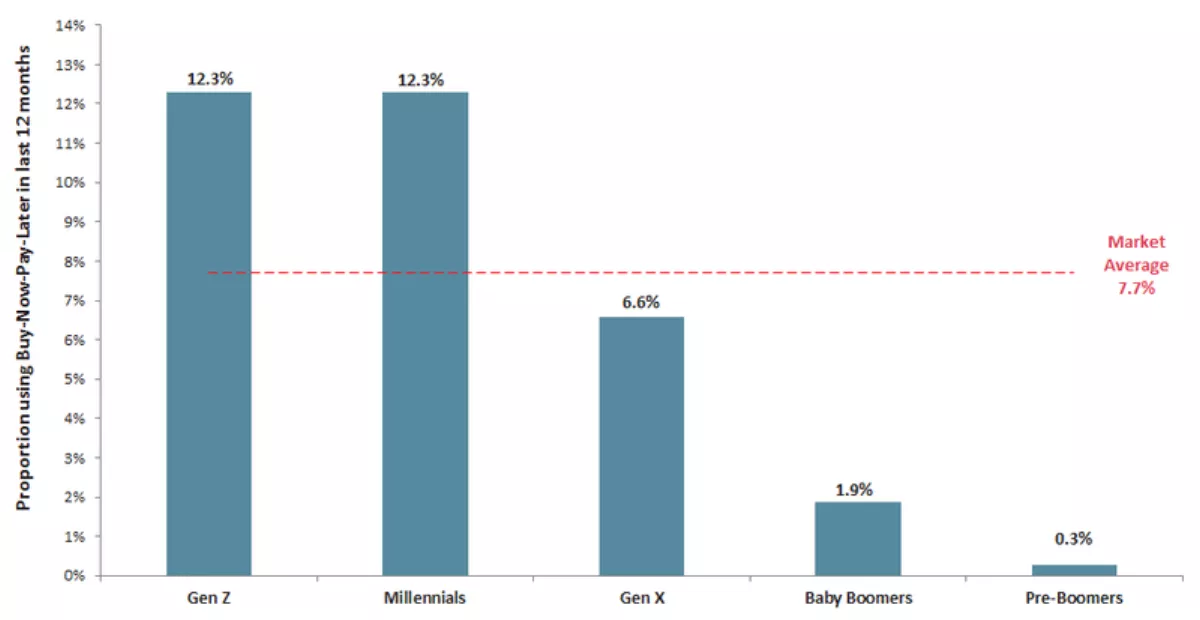

Currently, only 7.7% of the population use ‘buy-now-pay-later' systems but as this has developed over a relatively short time period it leaves a great deal of growth potential among all generations.

Even the big early adopters, millennials and Gen Z, currently have only 12.3% using these payment methods and the older generations (baby boomers and pre-boomers) have a very low level of less than 2%.

Buy-Now-Pay-Later Usage in Last 12 Months: Incidence by Generations

Source: Roy Morgan Single Source (Australia)

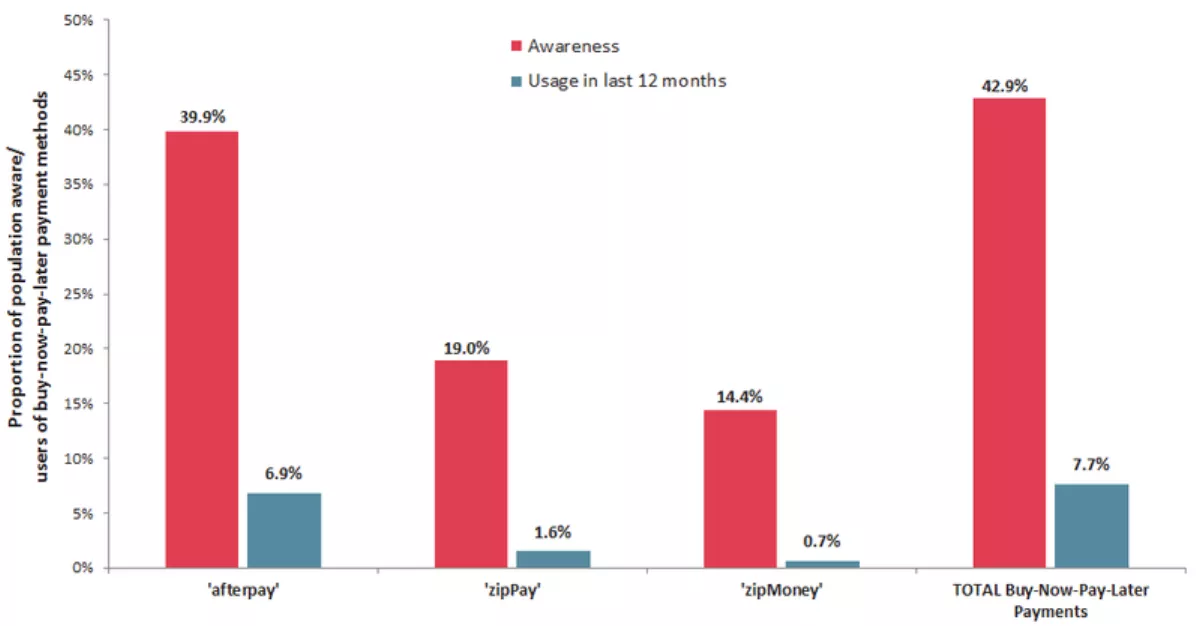

Awareness of these new payment methods is a healthy 42.9%, well ahead of the 7.7% usage levels and as a result, provides a positive growth outlook.

Clearly, the major player in this market is ‘Afterpay', with 39.9% awareness and 6.9% usage over a 12 month period, well ahead of second-placed ‘Zip' with 19.0% awareness and 1.6% usage.

Buy-Now-Pay-Later Payment Methods: Awareness v Usage in last 12 months

Source: Roy Morgan Single Source (Australia)

“These ‘buy-now-pay-later' companies are likely to pose a threat to traditional payment types such as credit cards as well as traditional financial institutions, as consumers can access a small amount of credit instantly with no documentation,” says Roy Morgan industry communications director Norman Morris.

“Consumers will come to expect the minimum effort when making payments and the industry will need to adapt to these changing expectations by providing more innovative and simpler solutions. Traditional financial institutions may need to collaborate with Fintechs and other third parties to keep up with the rapidly changing digital payment environment.